As property owners in Australia, understanding the expenses associated with rental properties is crucial. These expenses can have a significant impact on your finances and taxes. In this guide, we’ll provide a comprehensive overview of rental property expenses, so you can be better prepared and informed about the costs involved in owning a rental property.

Types of Rental Property Expenses

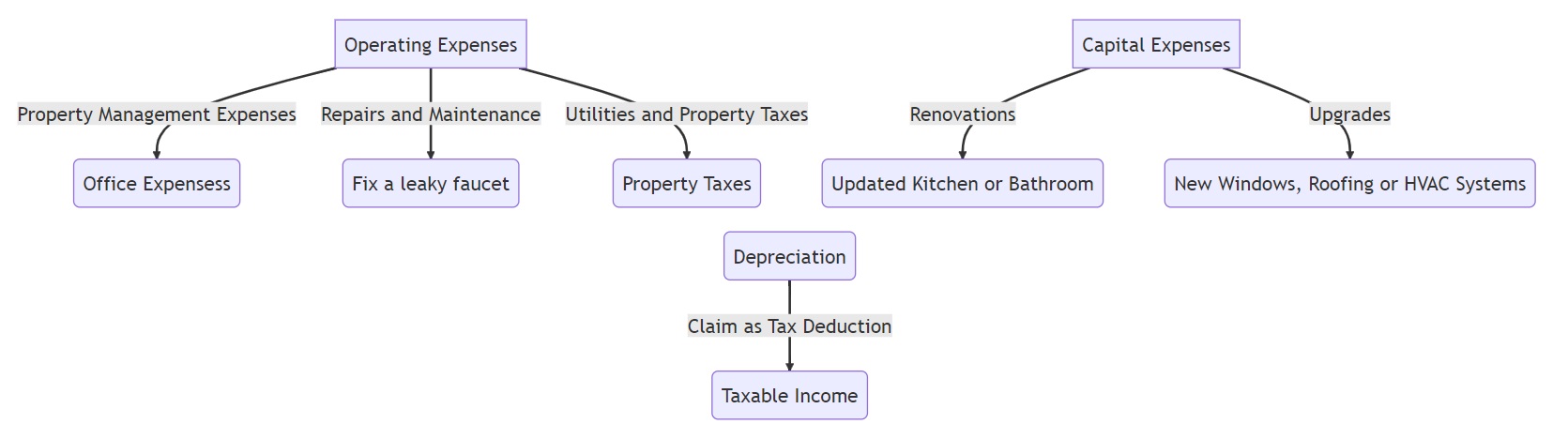

Operating Expenses

Operating expenses are the costs involved in running and maintaining a rental property. These expenses include maintenance, insurance, utilities, and property taxes.

One of the most significant operating expenses for rental property owners is property management fees. These fees cover a range of services, including tenant screening, rent collection, maintenance and repair coordination, and financial reporting. It’s important to note that property management fees vary by company and region, so it’s important to do your research to ensure you’re getting a fair deal.

Repairs and maintenance are also a significant operating expense for rental property owners. This can include everything from fixing a leaky faucet to replacing a broken HVAC system. It’s important to keep up with regular maintenance to avoid more significant and costly repairs down the line.

Utilities, such as electricity and gas, can also be an operating expense for rental properties. Depending on your lease agreement, you may be responsible for covering some or all of these costs. Property taxes are also an operating expense that rental property owners must pay.

Capital Expenses

Capital expenses refer to the costs of improving a rental property or adding value to it. These expenses include renovations, upgrades, and improvements that increase the property’s value or extend its useful life.

One common capital expense for rental property owners is renovations. Renovations can include anything from updating a kitchen or bathroom to adding a new room or expanding living space. These improvements can increase the rental value of the property and attract more tenants.

Upgrades, such as installing new windows, roofing, or HVAC systems, can also be a capital expense. These upgrades can improve the property’s energy efficiency and reduce operating costs.

Depreciation

Depreciation refers to the decrease in value of a rental property over time. As a rental property owner, you can claim depreciation as a tax deduction. This deduction allows you to account for the wear and tear on your property and reduce your taxable income.

Rental Property Expenses – If you are after a list

Now – if you want an actual list of potential deductions e.g. you don’t want to miss any small details either, here’s the list.

Conclusion

In conclusion, rental property expenses can be significant, but understanding the different types of expenses can help you budget and plan accordingly. Operating expenses, capital expenses, and depreciation are all important factors to consider as a rental property owner. By keeping up with regular maintenance and investing in improvements, you can increase the value of your property and attract more tenants. As always, it’s important to consult with a tax professional or financial advisor to ensure you’re getting the most out of your rental property investments.

We hope this guide has provided you with a comprehensive overview of rental property expenses in Australia. By understanding the different types of expenses, you can budget and plan accordingly, and make informed decisions about your rental property investments. Remember to keep up with regular maintenance and invest in improvements to increase the value of your property and attract more tenants. And as always, don’t forget to consult with a tax professional or financial advisor to ensure you’re getting the most out of your rental property investments.

If you have any questions or concerns about rental property expenses, don’t hesitate to reach out to us. We’re always here to help and provide you with the best possible advice and guidance for your rental property needs. Thank you for taking the time to read this guide, and we wish you all the best with your rental property investments.